How to Access eHub Allied Pay Stubs & eHub Allied W2s Form Online

- Use a computer or device that is connected to the internet; go to eHub Allied Pay Stubs Login

- https://ehub.aus.com/ehub/account/login

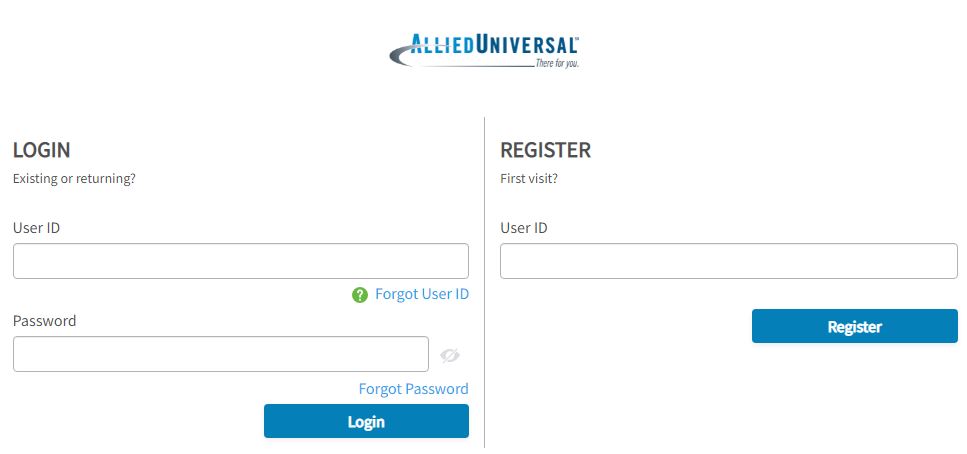

- You will be taken to the eHub Allied login page screenshot below you can see. ehub pay stubs

- Enter your username and password to sign in to the system. [User ID; Tips Password, Associate ID Most recent password]. Click on the Login button. ehub pay stubs

Check More Posts,

- Freetoolbox login

- Atc Payroll login

- Bluebook Login

- Rightnowmedia login

- Infinet login

- Alta Tennis login

- Powertest Teacher login

- Ccfcu login

- Suncu Org login

- Itv Email login

- VCH Pay Stub Login Portal

- Cheesecake Factory Pay Stubs Login

- CSL Plasma Pay Stubs Login

- Culver’s Pay Stubs Login

- Flagstaff Pay Stubs Login

- Workforce Pay Stub Login

- UNC Pay Stub Login

- Flip Pay Stubs Login

- Flynn Pay Stubs Login

- Flagstaff Pay Stubs Login

eHub Allied Pay Stubs Login Online

- If you’re a new user, it’s important to follow the right steps to ensure the security of your account. Your initial password will be a combination of your date of birth (DOB) in MMYY format and the last four digits of your Social Security Number (SSN). For example, if your DOB is 01 December 1989 and the last four digits of your SSN are 6789, your username will be 12896789.

- During the first-time login, you will be asked to select and provide answers to five security-related questions. These questions may include information about the city you were raised in, the name of your closest friend, the name of the town where you went to school, the model of your first vehicle, and your childhood idol. Make sure to click the “Save” option after answering each question to proceed to the next step.

- It is highly recommended to change your password after logging in for the first time. To do this, simply enter your temporary password and choose a new password that you want to use. It’s important to choose a strong and unique password that includes a combination of letters, numbers, and special characters to enhance the security of your account.

- Once you have changed your password, you will have access to your dashboard, which will provide you with an overview of your account. To view your pay stubs, click on the “Pay Stubs” tab and then click the “View” icon. You can choose to download your pay stubs in PDF format or send them to yourself with or without a password for added security.

- To access your W-2 forms, select the “W-2” tab and then click the “Co-View” icon. Your W-2 forms will be downloaded in a password-secured PDF file. It’s important to note that you must use your SSN without dashes as a password in order to access your W-2 forms.

- Lastly, it’s crucial to remember to log out of your account whenever you’re done using it. This will help ensure the security of your account and protect your personal information. Keeping these security measures in mind will help you safely manage your account and protect your sensitive data. eHub Allied Pay Stubs Login

Some Useful FAQ For eHub Allied Pay Stub Portal

eHub Allied Pay Stubs is an online portal that allows Allied Universal employees to access their pay stubs and other important information related to their employment.

To access your eHub Allied Pay Stubs, you need to visit the eHub Allied Pay Stubs Login page and enter your login credentials, including your username and password.

If you forget your eHub Allied Pay Stubs login credentials, you can click on the “Forgot Password” link on the login page and follow the instructions to reset your password.

Yes, you can access your eHub Allied Pay Stubs from your mobile device by visiting the eHub Allied Pay Stubs Login page and logging in with your credentials.

eHub Allied Pay Stubs are updated on a bi-weekly basis, which means that you will be able to access your most recent pay stubs every two weeks.

Yes, you can view your eHub Allied Pay Stubs from previous years by logging into the eHub Allied Pay Stubs portal and selecting the appropriate date range.

To print your eHub Allied Pay Stubs, you need to log into the eHub Allied Pay Stubs portal and select the pay stub you want to print. Then, click on the “Print” button to print a hard copy.

In addition to your pay stubs, you can also access your tax information, benefits information, and other important employment-related information through the eHub Allied Pay Stubs portal.

If you have a question about your eHub Allied Pay Stubs, you can contact the Allied Universal HR department for assistance.

Yes, the eHub Allied Pay Stubs portal is secure and uses industry-standard encryption to protect your personal and financial information.

No, you can only access your eHub Allied Pay Stubs if you are currently employed by Allied Universal.

To update your personal information on the eHub Allied Pay Stubs portal, you need to contact the Allied Universal HR department and provide them with the updated information.

If you have trouble logging into the eHub Allied Pay Stubs portal, you can contact the Allied Universal IT department for assistance.

Yes, you can access the eHub Allied Pay Stubs portal from anywhere in the world as long as you have an internet connection.

You will automatically be enrolled in the eHub Allied Pay Stubs portal when you become an employee of Allied Universal.

Click For More Articles: https://paystub.onl/