Allied Universal Pay Stub Login: Are you looking for a way to access your Allied Universal pay stub online? If so, you’ve come to the right place.

In this article, we will walk you through the steps to log in to your Allied Universal pay stub portal and view your pay stubs.

See Here also,

- VCH Pay Stub Login

- Braum’s Pay Stubs Login

- Autozone Pay Stub Login

- Wendy’s PayStub Login

- Alorica Pay Stubs Login

- Genesis Pay Stub Login

- Cheesecake Factory Pay Stubs Login

- Dillard’s Pay Stubs Login

- EDUStaff Pay Stubs Login

- Snider Blake Pay Stub Login

Use a computer or device that is connected to the internet; go to Allied Universal Pay Stub Login

https://ehub.aus.com/ehub/Account/Login?ReturnUrl=%2Fehub%2F

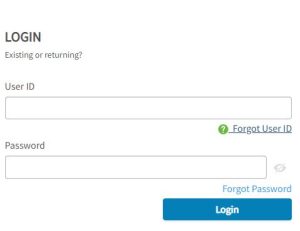

You will be taken to the Allied Universal login page screenshot below you can see.

- Enter your employee ID and password.

- If you have forgotten your password, you can click on the “Forgot Password?” link and follow the instructions.

- Once you have logged in, you will be taken to the Employee Self-Service portal.

- Click on the “Pay Stubs” tab.

- Select the pay stub that you want to view.

- Click on the “View” button.

Some Useful FAQ For Allied Universal Pay Stub Portal

An Allied Universal pay stub is a document that shows your earnings and deductions for a specific pay period. It includes information such as your gross pay, net pay, taxes withheld, and other deductions.

You can access your Allied Universal pay stub online through the Allied Universal Employee Self-Service portal. To do this, you will need your employee ID and password.

Your Allied Universal pay stub will include the following information:

Your name

Your employee ID

Your pay period

Your gross pay

Your net pay

Taxes withheld

Other deductions

Your pay rate

Your hours worked

Your benefits

Your Allied Universal contribution

Your Allied Universal pay stub will be available online within 24 hours of being generated.

If you lose your Allied Universal pay stub, you can request a duplicate copy through the Allied Universal Employee Self-Service portal.

If you need to change your Allied Universal pay stub information, such as your address or bank account number, you can do so through the Allied Universal Employee Self-Service portal.

An Allied Universal pay stub is a document that shows your earnings and deductions for a specific pay period. A W-2 form is a tax form that shows your total earnings and withholdings for the year.

You can use your Allied Universal pay stub to file your taxes by providing it to your tax preparer. Your tax preparer will use the information on your pay stub to calculate your taxes and determine how much you owe.

If you have a problem with your Allied Universal pay stub, such as an error in your earnings or deductions, you should contact Allied Universal Human Resources. Allied Universal will investigate the problem and correct it if necessary.

You should protect your Allied Universal pay stub information by keeping it in a safe place. You should also avoid sharing your pay stub information with anyone who does not need to see it.

Click For More Articles: https://paystub.onl/